Responsible investment is typically defined as an approach to investing that aims to incorporate environmental, social and governance (ESG) factors into investment decisions to better manage risk and generate sustainable, long-term returns. There is growing recognition among many investors across various asset classes that ESG issues can materially impact financial performance of their investments, while others remain skeptical. As a matter of fact, global sustainable investment assets have expanded dramatically in recent years to USD 21 trillion, outpacing the growth of total professionally managed assets(1). Worldwide, responsible investments comprised of at least 30% of assets under management(1). One of the key initiatives, the United Nations Principles of Responsible Investment (UN PRI), reported an accelerated growth of signatory members since establishment in 2006. Capital Dynamics signed the UN PRI in 2008. Today more than 1,500 companies have signed the principles(2). During 2015 alone, the number of UN PRI signatories reporting on their efforts increased by 15% to 936, with the initiative estimating a market penetration of 63% among asset managers. However, a much lower estimated market penetration (19%) among investors/asset owners indicates that only leading institutional investors have embraced responsible investment principles for investors’ portfolios.

1 Global Responsible Investment Alliance Report 2014.

2 www.unpri.org. Data is as of May 2016.

RESPONSIBLE INVESTMENT PRACTICES ARE BECOMING PREVALENT

Responsible investment is typically defined as an approach to investing that aims to incorporate environmental, social and governance (ESG) factors into investment decisions to better manage risk and generate sustainable, long-term returns. There is growing recognition among many investors across various asset classes that ESG issues can materially impact financial performance of their investments, while others remain skeptical. As a matter of fact, global sustainable investment assets have expanded dramatically in recent years to USD 21 trillion, outpacing the growth of total professionally managed assets(1). Worldwide, responsible investments comprised of at least 30% of assets under management(1). One of the key initiatives, the United Nations Principles of Responsible Investment (UN PRI), reported an accelerated growth of signatory members since establishment in 2006. Capital Dynamics signed the UN PRI in 2008. Today more than 1,500 companies have signed the principles(2). During 2015 alone, the number of UN PRI signatories reporting on their efforts increased by 15% to 936, with the initiative estimating a market penetration of 63% among asset managers. However, a much lower estimated market penetration (19%) among investors/asset owners indicates that only leading institutional investors have embraced responsible investment principles for investors’ portfolios.

WHY TAKE ESG FACTORS INTO ACCOUNT?

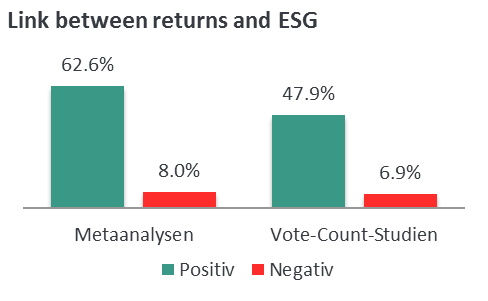

Various surveys indicate that a broad investor-asset owner community is still unsure about the value proposition of responsible investing. Possibly unaware of the relevant research in the ocean of academic and business studies, some investors perceive a disconnect between ESG factors and financial results. However, recent efforts to analyze all of these studies in order to gain a clearer picture yielded conclusive results. Oxford-Arabesque’s study of studies (2015) documented that companies with significant environmental concerns incur higher cost of capital stemming from higher spreads on debt and lower credit ratings, while governance issues can also lead to a rise of cost of equity. It also concluded that studies generally show a positive correlation between improved ESG ratings and operational performance. Similarly, a study from the University of Hamburg and Deutsche Bank (2015) aggregating and analyzing about 2,200 empirical studies demonstrated that approximately 90% of all meta-analyses(3) found a non-negative relation between ESG and corporate financial performance, with the share of positive findings by far exceeding negative results, as shown below. A similar proportion between positive and negative results were obtained for less robust vote-count studies(4).

Finally, researchers from Harvard Business School concluded in their latest paper (2016) that, historically, researches did not distinguish between material and immaterial ESG issues, thereby leading to the perception of mixed results. By classifying sustainability data and ESG issues in material and immaterial categories guided by the Sustainability Accounting Standards Board (SASB) Materiality Map(5), authors found that firms considering material ESG issues "enhanced value for shareholders" while investments in immaterial ESG issues had "little positive or negative, if any, value implications"(6).

LACK OF RESEARCH ON THE IMPACT OF RESPONSIBLE INVESTMENT PRACTICES ON PRIVATE EQUITY RETURNS

Historically, private equity was considered by institutional investors as a return enhancing strategy only, and given the low allocation to this asset class, the opaque nature of the industry, and the low publicity; few investors evaluated or asked about General Partners’ (GPs) considerations of ESG factors in the investment framework. Only a handful of GPs signed the UN PRI prior to the global financial crisis, while growth in signatories was more driven by Limited Partners (LPs); the relationship has since reversed. Given the immaturity of implementation and the long-term nature of private equity investments, it is not surprising that there is a lack of studies in private equity quantifying the impact of responsible investment practices on returns. Evidence is based on case studies and GP/LP surveys. After a diligent search, we have collated and analyzed the results of 17 private equity related surveys on this topic to crystalize common or conflicting findings and identify the relevant trends. Generally, we documented an increasing number of surveys, with the British Venture Capital Association conducting one of the first surveys in 2009. Our concern relating to the existing surveys is that they may be biased, as only firms that held strong views on ESG or had experience/started making efforts in committing to ESG participated.

ESG EFFORTS BY LPS IN PRIVATE EQUITY

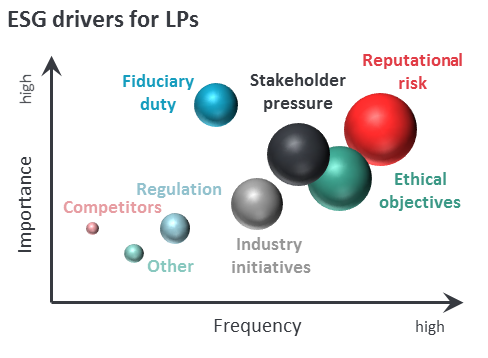

So, why do investors make an effort to integrate ESG factors in their investment process? We amalgamated responses from various surveys by considering the number of respondents citing a specific reason for ESG integration and its importance. As shown below, investors may commit to ESG policies due to various reasons, but managing reputational risk is one of the top reasons across all of the surveys analysed.

Source: Capital Dynamics analysis of various LP surveys.

Fiduciary duty implies that investors are acting in someone else’s interest. While one of the studies mentions risk-adjusted returns in this context, the concept certainly goes much further than that. A majority of respondents believe that ESG can lead to better risk-adjusted returns, however it seems that they attribute this to lower risk. Interestingly, value creation as a motivation was either not included as an option by surveyors or response values were not significantly high enough to report.

For those investors who adopted responsible investment principles, it became an important part of their manager selection process. Such investors may require the GP to have a specific ESG policy. Furthermore, LPs assess GP’s ESG-related processes and ask for examples of how ESG issues were addressed in the past. The best part of analysis is, however, of qualitative and subjective nature. The most telling sign of the importance of ESG for investors-adopters is that the overwhelming majority of them would decline to invest in the fund or make a co-investment depending on the results of ESG due diligence. Our own market observations suggest, however, that this is either a case of LPs deluding themselves or the acceptable standards being very low. When making a commitment, some investors require their ESG-driven clauses to be part of a side letter. While these may provide them with comfort, we question the value of such clauses, as only a GP’s practical implementation of responsible investment principles will truly make a difference. Also, responsible investing by an LP does not stop with the selection, it must continue during monitoring. However, just about two-thirds of LPs that signed the UN PRI and report on their implementation progress appear to engage with a GP during the life of the fund.

With respect to the most pressing issues, it appears that the majority of investors are mostly concerned about environmental issues, followed by governance related topics, with social issues being the least important. Despite the rapid appreciation of the ESG principles, many investors, especially outside of Europe, have not implemented ESG practices. Reasons for not adopting such practices range from a lack of conviction in the relevance of ESG to investments, to the opaque nature of commingled funds and a fear of lower performance.

HOW GPS IMPLEMENT ESG PRINCIPLES

Various GP surveys indicate that the majority of GP respondents have a formalized ESG policy and processes in place. This is equally driven by the recognition of the ESG factors’ influence on risk mitigation and by investor pressure. In contrast, LP surveys indicate that the majority of GPs they reviewed did not implement ESG principles in their investment processes. The discrepancy perhaps lies in the non-response bias of GP surveys and reveals a potential mismatch in supply and demand. Echoing surveys and market data from public markets, a higher share among European GPs have an ESG policy compared to their US counterparts.

The surveys come to the same conclusion – larger firms are more likely to have incorporated the management of ESG factors throughout the deal life cycle than smaller ones, which is not surprising given that larger private equity firms are more likely to have institutionalized processes and adequate resources to carry out the analysis and monitoring. However, in our experience, ESG issues are considered as part of the overall risk management widely across all firm sizes. Smaller firms just seem to have a lesser degree of communication or formalization. The importance of ESG factors during the investment process is rated as very high by respondents. This stems from the overall risk due diligence GPs perform on targets or during the screening of opportunities, leading to the potential abandonment of an investment due to ESG issues. GPs appear to consider ESG factors more frequently during the pre-screening and acquisition phases than during ownership, with the level dropping significantly at the exit stage. The results indicate a lack in consistency of implementation across all stages. Taking the respondents’ bias into account, these findings seem to suggest that for many GPs, ESG factors are primarily used as a negative screen in the investment selection and policies are merely drawn up to satisfy LPs. This is a disappointing finding given what we believe it to be a strong value creation potential during ownership and exit.

VALUE CREATION THROUGH RESPONSIBLE INVESTING

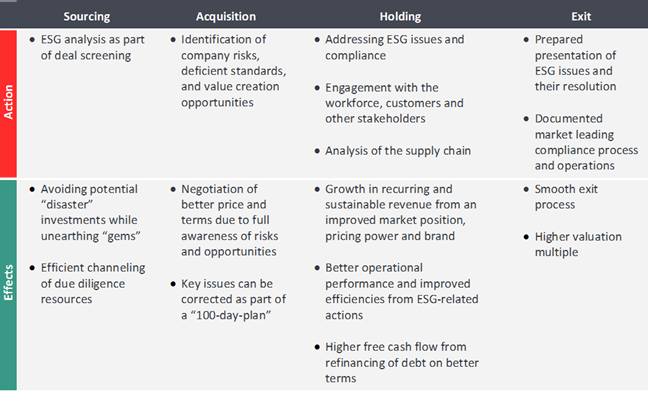

Examples of value-add of ESG in the PE deal cycle

Reflecting on findings from publicly traded companies’ research, we maintain that ESG factors have a greater relevance to private equity investments. For example, gains from a lower cost of debt would have a higher financial impact on PE-backed companies due to leverage-driven capital structures in buyout transactions, boosting value creation from free cash flows. While some ESG actions can directly lead to the increased level of sustainable revenues and a higher EBITDA due to cost savings, improvements in the ESG rating of the company during ownership can make the target more attractive for potential bidders and increase the number of suitors willing to do a deal. Furthermore, a company that is fully prepared to exit in terms of ESG implementation and documentation can enjoy a smooth exit process, thereby commanding an improved valuation resulting in a higher value creation from the multiple expansion.

Many GPs have long been using ESG factors to identify risks while making investments. Increasingly, some GPs recognize its benefits to drive value creation. For instance, an opportunity for value creation was cited as a driving force for ESG implementation by 15% of the PwC (2013) survey respondents. More recently, a quarter of UN PRI GP reporting signatories said in the 2016 survey that ESG impacted the price paid/offered for their investments, implying a direct impact of ESG on the financial outcome for investors. Moreover, in the most recent survey by ERM (May 2016) of 60 ESG leaders, 70% of GP and LP respondents believed ESG materially impacted their investments. Yet, the larger part of material impact was believed to be driven by protecting value (60%) respectively risk management. Encouragingly, 40% of respondents recognized the value creation potential of implementing ESG principles. Margin enhancement due to ESG/RI actions has been identified as a major source of value creation, which is not surprising given the relative ease of measuring cost savings from ESG actions. Given the long-term nature of private equity investing, we believe it is paramount that GPs tackle ESG factors during their ownership of a company bought today. When a company is to be sold in five to seven years’ time and standards will have further evolved, neglecting these principles will very likely have a negative impact on valuation. As confirmed by the evidence from research on public companies, Capital Dynamics believes that responsible investing in private equity will lead to enhanced long-term financial returns. While more and more GPs may have specific processes and tools to create value from ESG-focused initiatives, few firms attempt to quantify the ESG impact. Across various surveys, only about 9-14% of survey respondents measured how ESG impacted the financial performance. Finally, only 5% of private equity-backed portfolio companies of GPs surveyed by ERM say they have realized sustainable value creation opportunities fully.

OUTLOOK

As conveyed by many surveys, we expect a continued increase in the importance of ESG for both GPs and LPs. We believe that the private equity industry will follow the growth of responsible investment practices in listed equities, enjoying greater levels of investor attention. Further, we expect rapid improvements in the GPs’ communication of their responsible investment efforts to investors and generally to the public. For investors, it will be crucial to lift the curtain and look behind these marketing efforts. While sustainable corporate management has been shown to increase operational performance and reduce business risks, studies also point to the need for it to be deeply embedded into an organization’s culture and values to have such an effect. The investment model of private equity reduces the agency issues and procedural hurdles for an investor in implementing such change – if the GP itself indeed implements what it portrays to investors. Therefore, analyzing the incorporation of ESG principles and measuring its impact on value commands a pivotal role in due diligence.

References

- Arabesque Partners, University of Oxford.2015. From the stockholder to the stakeholder: How sustainability can drive financial performance

- BVCA. 2009/2011. Evolving views of sustainability in private equity and venture capital

- Commonfund. 2015. Study of Responsible Investing

- Coller Capital, EMPEA. 2011. Global Private Equity Survey

- Deutsche Bank, University of Hamburg. 2015. ESG & Corporate Financial Performance: Mapping the global landscape

- Ecole Polytechnique ParisTech. 2012. Think Global, Invest Responsible: Why the Private Equity Industry Goes Green

- ERM. 2016. ESG: The Multiplier Effect

- Global Sustainable Investment Alliance. 2014. Global Sustainable Investment Review

- Khan M., Serafeim G., Yoon A. Harvard Business School. 2016. Corporate Sustainability: First Evidence on Materiality

- London Business School, Adveq. 2015. ESG moving out of the Compliance Room and into the Heart of the Investment Process

- Malk Sustainability Partners. 2015. ESG in Private Equity

- Mercer/LGT. 2015. Global Insights on ESG in Alternative Investing

- Pitchbook. 2016/2015/2013. Private Equity ESG

- PwC. 2015. Bridging the gap: Aligning the Responsible Investment interests of Limited Partners and General Partners

- PwC. 2013. Putting a Price on Value

- PwC. 2012. Responsible investment: creating value from environmental, social and governance issues

- PwC. 2012. The integration of environmental, social and governance issues in mergers and acquisitions transactions

- United Nations Principles of Responsible Investment. 2016. Report on Progress in Private Equity

1 Global Responsible Investment Alliance Report 2014.

2 www.unpri.org. Data is as of May 2016.

3 Meta-analyses is a method for systematically combining pertinent qualitative and quantitative study data from several selected studies to develop a single conclusion that has greater statistical power.

4 Vote-count studies count the number of studies with significant positive, negative, and nonsignificant results and weigh them against each other.

5 http://materiality.sasb.org. SASB’s Materiality Map identifies likely material sustainability issues on an industry-by-industry basis. E.g., for companies in Financials sector, supply chain management is an immaterial governance factor while systemic risk management is a material factor.

6 Khan M., Serafeim G., Yoon A. Harvard Business School. 2016. Corporate Sustainability: First Evidence on Materiality.

Disclaimer

This document is provided for informational and/or educational purposes. The opinions expressed are as of June 2016 and may change as subsequent conditions vary. The information herein is not to be considered investment advice and is not intended to substitute for the exercise of professional judg-ment. Recipients are responsible for determining whether any investment, security or strategy is appropriate or suitable and acknowledge by receipt hereof that neither Capital Dynamics AG nor its affiliates (collectively, "Capital Dynamics") has made any determination that any recommendation, invest-ment, or strategy is suitable or appropriate for the Recipient’s investment objectives and financial situation. A reference to a particular investment or security by Capital Dynamics is not a recommendation to buy, sell or hold such investment or security, nor is it an offer to sell or a solicitation of an offer to buy such investment or security. Capital Dynamics may have a financial interest in investments or securities discussed herein or similar investments or securities sponsored by an asset management firm discussed herein. Certain information and opinions herein have been provided by a number of sources that Capital Dynamics considers to be reliable, but Capital Dynamics has not separately verified such information. Nothing contained herein shall constitute any representation or warranty and no responsibility or liability is accepted by Capital Dynamics as to the accuracy or completeness of any information supplied herein. Before relying on this information, Capital Dynamics advises the Recipient to perform independent verification of the data and conduct his own analysis hereto with appropriate advisors. Analyses contained herein are based on assumptions which if altered can change the conclusions reached herein. Capital Dynamics reserves the right to change its opinions or assumptions without notice. This document has been prepared and issued by Capital Dynamics and/or one of its affiliates. In the United Kingdom, this document is issued by Capital Dynamics Ltd., which is authorized and regulated by the Financial Conduct Authority. For residents of the UK, this report is only directed at persons who have professional experience in matters relating to investments or who are high net worth persons, as those terms are defined in the Financial Services and Markets Act 2000. In the EU, this document is issued to investors qualifying as professional investors (as that term is defined in the Alternative Investment Fund Managers Directive) by Capital Dynamics Limited (authorised and regulated by the Financial Conduct Authority). Registered office: 9th Floor, 9 Colmore Row, Birmingham, West Midlands, B3 2BJ, Company No. 02215798. In the United States, this document has been issued by Capital Dynamics Inc., an SEC-registered investment advisor. Redistribu-tion or reproduction of this document is prohibited without written permission.